分类

商品

- 商品

- 店铺

- 资讯

FinTech Innovation examines the rise of financial technology and its growing impact on the global banking industry. Wealth managers are standing at the epicenter of a tectonic shift, as the balance of power between offering and demand undergoes a dramatic upheaval. Regulators are pushing toward a 'constrained offering' norm while private clients and independent advisors demand a more proactive role; practitioners need examine this banking evolution in detail to understand the mechanisms at work. This book presents analysis of the current shift and offers clear insight into what happens when established economic interests collide with social transformation. Business models are changing in profound ways, and the impact reaches further than many expect; the democratization of banking is revolutionizing the wealth management industry toward more efficient and client-centric advisory processes, and keeping pace with these changes has become a survival skill for financial advisors around the world.

Social media, big data analytics and digital technology are disrupting the banking industry, which many have taken for granted as set in stone. This book shatters that assumption by illustrating the massive changes already underway, and provides thought leader insight into the changes yet to come.

Information asymmetry has dominated the banking industry for centuries, keeping the bank/investor liability neatly aligned--but this is changing, and understanding and preparing for the repercussions must be a top priority for wealth managers everywhere. Financial Innovation shows you where the bar is being re-set and gives you the insight you need to keep up.

Innovation in financial technology has only begun to disrupt the wealth management industry, and is leading to a tectonic shift whereby investors and tech-savvy financial advisors can become the new price-makers in the global democratization of banking. FinTech Innovation delves deep beyond simply describing the disruption examining, in detail, the underlying processes to illuminate exactly what is happening and why it's happening so that you can engage with and thrive in the new marketplace.

Through a behind-the-scenes look at Robo- Advisors and their part in the turnkey, low-cost personalization of Goal Based Investing, this cutting-edge guide opens a tangible path for using technology to gain a competitive advantage, establish your value as a human advisor and "rewire" investors' minds to positively engage with investing.

If you want to implement efficient, personalized investing, you want FinTech Innovation at your side.

This authoritative guide from a global expert on quantitative financial analysis and digital technology pulls back the curtain to reveal:

PAOLO SIRONI is a global thought leader for Wealth Management and Investment Analytics at IBM, where he is responsible for promoting quantitative methods, Goal Based Investing (GBI) and digital solutions for financial advisory. His expertise combines financial services and technology and spans over a number of areas, including wealth management, asset management, risk management and FinTech innovation. Prior to IBM, he founded a FinTech startup that provided GBI portfolios to wealth managers. This venture subsequently became a part of IBM following the acquisition of funding partner Algorithmics, a world leader of risk management and investment analytics. Paolo possesses a decade-long risk management expertise; he was previously head of market and counterparty risk modeling at Banca Intesa Sanpaolo. He is the author of Modern Portfolio Management: From Markowitz to Probabilistic Scenario Optimisation, and contributing author to The FinTech Book.

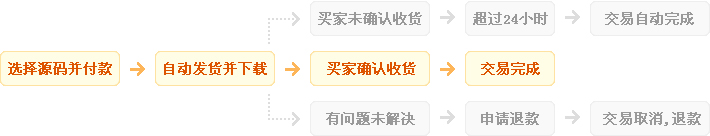

发货方式

自动:在特色服务中标有自动发货的商品,拍下后,源码类 软件类 商品会在订单详情页显示来自卖家的商品下载链接,点卡类 商品会在订单详情直接显示卡号密码。

手动:未标有自动发货的的商品,付款后,商品卖家会收到平台的手机短信、邮件提醒,卖家会尽快为您发货,如卖家长时间未发货,买家也可通过订单上的QQ或电话主动联系卖家。

退款说明

1、源码类:商品详情(含标题)与实际源码不一致的(例:描述PHP实际为ASP、描述的功能实际缺少、功能不能正常使用等)!有演示站时,与实际源码不一致的(但描述中有"不保证完全一样、可能有少许偏差"类似显著公告的除外);

2、营销推广类:未达到卖家描述标准的;

3、点卡软件类:所售点卡软件无法使用的;

3、发货:手动发货商品,在卖家未发货前就申请了退款的;

4、服务:卖家不提供承诺的售后服务的;(双方提前有商定和描述中有显著声明的除外)

5、其他:如商品或服务有质量方面的硬性常规问题的。未符合详情及卖家承诺的。

注:符合上述任一情况的,均支持退款,但卖家予以积极解决问题则除外。交易中的商品,卖家无法修改描述!

注意事项

1、在付款前,双方在QQ上所商定的内容,也是纠纷评判依据(商定与商品描述冲突时,以商定为准);

2、源码商品,同时有网站演示与商品详情图片演示,且网站演示与商品详情图片演示不一致的,默认按商品详情图片演示作为纠纷评判依据(卖家有特别声明或有额外商定的除外);

3、点卡软件商品,默认按商品详情作为纠纷评判依据(特别声明或有商定除外);

4、营销推广商品,默认按商品详情作为纠纷评判依据(特别声明或有商定除外);

5、在有"正当退款原因和依据"的前提下,写有"一旦售出,概不支持退款"等类似的声明,视为无效声明;

6、虽然交易产生纠纷的几率很小,卖家也肯定会给买家最完善的服务!但请买卖双方尽量保留如聊天记录这样的重要信息,以防产生纠纷时便于送码网快速介入处理。

送码声明

1、送码网作为第三方中介平台,依据双方交易合同(商品描述、交易前商定的内容)来保障交易的安全及买卖双方的权益;

2、非平台线上交易的项目,出现任何后果均与送码网无关;无论卖家以何理由要求线下交易的(如:要求买家支付宝转账付款的,微信转账付款的等),请联系管理举报,本平台将清退卖家处理。

¥215.00

¥215.00

正版 steam 原子之心 Atomic Heart 国区激活码 cd...

¥269.00

¥269.00

steam 英雄连3 国区激活码CDKEY PC游戏正版 Compan...

¥734.95

¥734.95

M,日朋礼送男友老公创意实人用星人际机器蓝牙音箱走心情节生礼...

¥285.00

¥285.00

zippo之宝官方正品打火机古银双面贴章机器人煤油机送男友礼物女...

¥88.00

¥88.00

秋季圆领卫衣套头男友风秋天长袖时尚潮流印花卡通机器派大星上衣...

¥98.00

¥98.00

机器猫情侣衬衫小叮当落肩短袖衬衣男友外套大码潮流套装上衣薄款...

¥568.00

¥568.00

PDPAOLA小机器人情侣手链女男生日礼物520送男友男士款闺蜜Rob...

¥9.00

¥9.00

兼容乐高复仇者联盟4战争机器积木人仔钢铁侠救援机甲玩具WM723...

¥12.9

¥12.9

兼容乐高复联4钢铁侠X0252灭霸MK50 MK1战争机器拼装积木人仔...

¥26.8

¥26.8

XBOX ONE SERIES X|S 中文 战争机器4与光环5守护...

¥149.8

¥149.8

【出版社旗舰店】动手学深度学习PyTorch版 精装版 李沐 人工智能...

¥19.9

¥19.9

火影的生活v0.12安卓 SLG AI汉化版 AI创作 但是...

¥68.00

¥68.00

达瓦猎手鱼竿手杆超轻超硬28调19调十大台钓竿黑坑鲫鱼钓鱼竿正品...

¥12.9

¥12.9

数字变形益智玩具 拼装合体机器人3-6岁儿童字母金刚机甲汽车男孩...

¥10.88

¥10.88

疯狂森林维修服务单机器设备故障维修收款收据家电门锁售后维修收费单电器维...

¥145.00

¥145.00

PC正版 steam游戏 双点校园 双点大学 Two Point Ca...

¥198.00

¥198.00

班尼兔棉花糖机儿童家用全自动做绵花糖机器手工制作迷你花式彩糖...

¥79.00

¥79.00

美珑美利 匠心菜刀 小菜刀 切片刀 砍骨刀 厨刀 水果刀 冻肉刀...